Custom Engagement Solutions

Unlock tailored solutions with a free, no-obligation strategy session.

Expert Developers & Engineers on Demand

Scale Your Team with Skilled IT Professionals

Expert Guidance for Digital Transformation

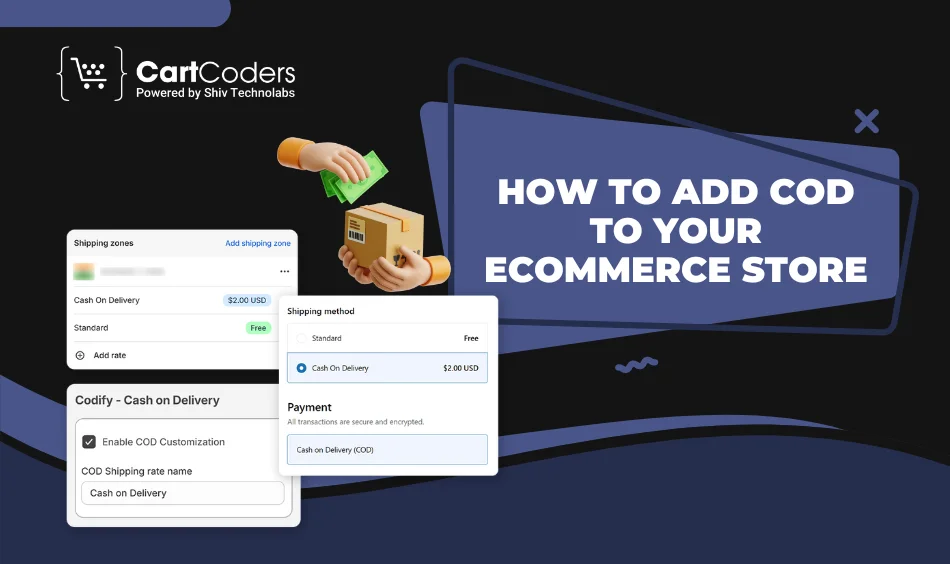

Running an online store means offering payment options that customers trust. Cash on delivery (COD) allows customers to pay after receiving their orders. The tax you collect on sales is VAT (Value Added Tax). Local delivery refers to the method of delivering goods at a local level.

These three features can boost your sales and make customers happy. COD builds trust because customers don’t pay upfront. VAT keeps you legal with tax rules. Local delivery saves money and gets products to customers faster.

This guide shows you how to add these features to your store.

You’ll learn step-by-step instructions for different platforms. We’ll cover common mistakes and how to avoid them. By the end, you’ll know exactly how to set up COD, VAT, and local delivery for your eCommerce business.

In 2025, eCommerce success does not entirely rely on products. Offering a cash-on-delivery option, applying the correct VAT, and enabling local delivery has become important now. But why?

Let’s have a look to get the answer:

If you add COD to store, it removes the biggest worry customers have about online shopping. They don’t have to give their credit card details to unknown stores. Buy Now Pay Later transactions in the United States were estimated at $133 billion in 2024, showing that customers want flexible payment options.

When customers see COD as an option, they feel safer. This means more people will buy from your store.

Not everyone has a credit card or likes to shop online with a card. COD opens your store to these customers. Local delivery enables you to reach people in your area who prefer fast shipping.

2024 U.S. ecommerce sales reached $1.192 trillion, which is more than double what they were five years prior. Adding COD and local delivery helps you get a bigger share of this market.

If you setup VAT in eCommerce, it keeps you legal with tax authorities. Most states have substantial sales thresholds for sales tax nexus. The most common is $100,000 in gross annual sales or 200 transactions in the last four quarters.

Cash on delivery (COD) allows customers to pay after receiving their orders. This mode of payment helps to win the trust of new buyers who are concerned about online fraud. Let’s find out how to add COD in your eCommerce Store:

VAT (Value Added Tax) or sales tax is a tax that you collect from customers on behalf of the government. In the US, each state has different tax rates and rules. Here is how you can implement it in your eCommerce store:

Shopify Tax Configuration:

WooCommerce Tax Setup:

Local delivery integration gives you a competitive edge over larger competitors. Customers get their products faster, and you save on shipping costs. During the eCommerce store setup, enabling local delivery helps you meet customer expectations and manage shipping efficiently. The setup process of local delivery in your eCommerce store is as follows:

Here are common mistakes to avoid:

Always test your COD setup by placing a test order. Check that the order shows up in your admin and you get the proper notifications.

Tax rules vary by state. Check tax rates for each state you sell to and update rates when they change.

Don’t promise delivery to areas you can’t reach. Only offer local delivery where it is feasible.

Installing COD, VAT, and local delivery would be a game-changer in your e-commerce business. These functionalities create customer confidence, and you secure the legal requirements and gain an advantage over your competitors at the local market.

Although setting it up may seem complicated, the benefits are well worth it. Looking ahead, you will experience more conversions, delighted customers and improved business.

Do you need professional help with setting up these features? CartCoders offers development and customisation for eCommerce.

CartCoders is familiar with the most popular e-commerce platforms, including Shopify, WooCommerce, Magento, and BigCommerce. We offer local shipping, COD, and VAT, and ensure your setup is correct the first time, so you don’t waste time and risk making costly mistakes. Contact CartCoders today.

Projects delivered in 15+ industries.

95% retention rate, building lasting partnerships.

Serving clients across 25+ countries.

60+ pros | 10+ years of experience.