Custom Engagement Solutions

Unlock tailored solutions with a free, no-obligation strategy session.

Expert Developers & Engineers on Demand

Scale Your Team with Skilled IT Professionals

Expert Guidance for Digital Transformation

Starting a thriving marketplace is much more complicated than starting a typical ecommerce store. Most of these marketplace platforms are not failing because there is no demand to be met, but because they are built without a robust operational feature set. According to the reports, online sales account for 22% of total global retail sales.

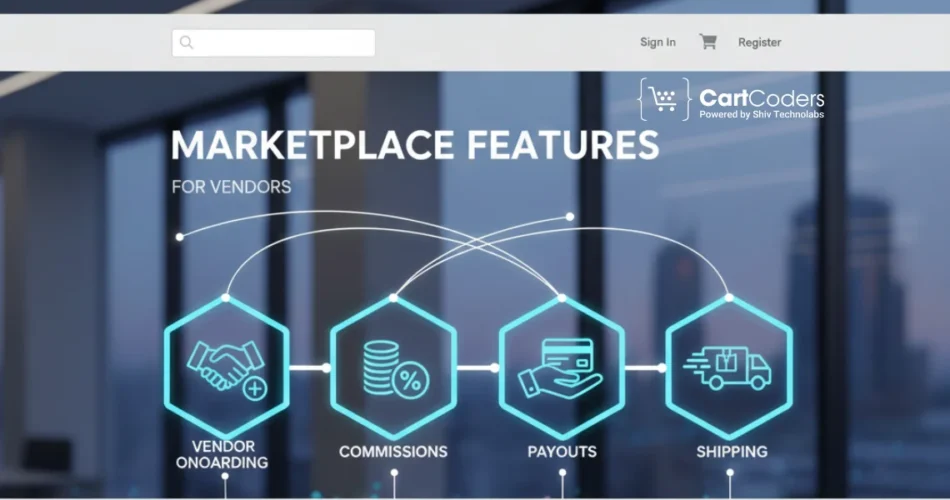

Vendor onboarding, vendor commission structures, vendor payouts, shipping logic and tax compliance are not isolated features. They consist of closely interrelated operational mechanisms that directly affect trust, scalability, and legal compliance, particularly for USA based marketplaces.

Failure to plan well in any of these aspects may result in churn among sellers, payment delays, tax offences, and customer dissatisfaction.

The guide is segmented into key marketplace specifics that any USA-focused platform must consider before launch, with particular attention to vendor integration, payouts, shipping, and compliance preparedness.

Any multi-vendor marketplace is based on vendor onboarding. It determines the entry mode of the sellers in the platform, the speed at which they are operational and the level of trust that the marketplace will develop with the sellers or the buyers.

Onboarding in a vendor onboarding marketplace is the process of registering. It is a structured

method of verifying the sellers, gathering business information, granting privileges and preparing them to sell in a compliant manner. A robust onboarding program minimises fraud, enhances listing quality, and speeds up seller activation.

Single-seller platforms focus on internal processes. Multi-vendor marketplaces have to take care of external businesses that have different levels of compliance, tax liability and fulfillment models. The seller onboarding marketplaces thus necessitate verification processes, approval processes, as well as role-based access, which is never required in a single seller store.

Easy onboarding directly influences seller conversion rates. Complex or ambiguous flows boost drop-offs, and ineffective validated sellers pose long-term operational risk. The liquidity in the marketplace and the activation of sellers are often increased in marketplaces where the onboarding process has been optimized.

A strong marketplace onboarding flow includes:

Sellers make accounts that include verified email address, passwords and profile information, which the buyer can see.

First, the name of the business used legally, address, contact details of the support, and the place of business are obtained to facilitate compliance and payouts.

All categories should not be open to all sellers. Regulated permissions are used to ensure quality and regulatory congruence.

Sellers are given dashboards with limited access, based on role, to ensure they can access only certain features.

A marketplace will not collapse due to design or traffic. Major breakdowns occur when essential operational elements are either not provided or poorly planned. Such characteristics define the way vendors work, flow of money, the fulfilment of orders, and compliance. Here are ten features that any serious marketplace cannot afford to take for granted since its inception.

A marketplace has to regulate the sellers. Lack of an open registration model with no approval would be a source of fraud, low-quality listing, and compliance risk.

The platform can conduct a vendor registration flow through which it can review sellers’ details, check documents, and reject or approve applications according to predefined criteria.

This aspect inspires confidence among consumers and secures the brand in the marketplace at the same time creating a marketplace filled with only authentic sellers.

As soon as it is approved, sellers should have a practical, direct onboarding experience.

A specific vendor onboarding marketplace dashboard helps vendors complete setup tasks, including creating a profile, uploading products, and setting payment and shipping preferences. Clarity.

The onboarding process will reduce sellers’ confusion, accelerate activation, and reduce reliance on support during the initial interaction.

Any marketplace should have a revenue engine. An adjustable marketplace commissioning model enables the platform to establish a percentage fee, a flat fee, a category fee or tiered pricing.

Flexibility is essential, as variations in seller types, products, or promotional campaigns may require different commission structures to remain competitive and profitable.

Commission calculation is not scalable. An automatic commission management marketplace system calculates platform fees at the order level, processes refunds and cancellations correctly, and generates accurate settlement reporting. This characteristic eliminates accounting errors, minimises disagreements among sellers, and provides financial transparency in the marketplace.

Sellers are concerned with the timing of payment to them. A reliable seller-payout-schedule marketplace feature defines payout frequency, minimum thresholds, and holding periods. It enables the site to control cash flow, ensure against chargebacks and create explicit expectations with the sellers. Open payout timetables enhance sellers’ retention and confidence.

The marketplace settlement cycle is the interval between order settlement and the payment to the seller. This is a critical window in fraud prevention, solid returns and payment processor compliance. An optimized settlement cycle satisfies sellers’ needs, manages platform risk, and enables scaled financial operations.

Shipping in a multi-vendor environment cannot be a one-size-fits-all. The rules of marketplace shipping should accommodate varying fulfillment points, carriers, delivery schedules, as well as calculations of the rate per seller. This is flexible in the way vendors can control logistics.

Marketplaces should offer real-time access to the status of orders for both sellers and buyers. This involves confirming the order, shipment, and tracking information, as well as delivery. Good visibility into fulfilment minimises support tickets, avoids conflicts, and builds confidence among buyers in the multi-seller setting.

Conflicts bind the marketplaces. It has an integrated dispute management system that defines how returns, refunds, cancellations, and complaints are to be managed between buyers, sellers, and the platform. The use of clear workflows safeguards the marketplace against liability and maintains just resolution and a uniform customer experience.

A marketplace to be run in the USA needs to be compliance-oriented from inception. This will involve tax management, seller validation, payout policies and audit-ready reporting. A system that is ready to comply with its architecture avoids the expensive rework that follows and makes the platform grow without legal or operational bottlenecks.

One of the most sensitive operations of a US marketplace is sales tax compliance.

Knowing Marketplace Sales Tax Responsibility. In some US states, marketplace facilitator laws shift sellers’ tax liability.

Platform.

Key considerations include:

Lack of control over sales tax compliance in the USA marketplace may lead to fines and audits.

Appropriate MVM marketplace taxation settings for the USA:

The logic of taxes should be programmable and recordable.

US laws require that markets verify sellers before paying them.

Verifying the sellers helps to safeguard against fraud, money laundering, and regulatory breaches. Marketplaces need to authenticate the seller identities and release funds with the help of payment processors.

The US requirements of sellers in terms of payout amounts usually involve:

Payouts may be blocked or postponed without proper KYC procedures.

Shipping Multi-vendor platforms have shared responsibility.

The integration of the US shipping carriers allows:

Popular American Shipping Carriers applied in the Marketplaces.

Enables business shipping, negotiated rates, and premium tracking.

Perfectly suitable for small packages, PO boxes, and economical domestic delivery.

Delivers quickly and offers advanced international logistics.

To create a thriving marketplace in the USA, appealing UI and product listings are not enough. It involves rigorous operational planning across onboarding, commissions, payouts, shipping, and compliance. All these systems need to operate in a manner that they do not expose the company to legal action, dissatisfaction with the seller, and also create a bottleneck in the operations.

CartCoders is a vendor onboarding marketplace development company focused on developing scalable, compliance-ready solutions that enable long-term growth. Our team is knowledgeable about US marketplace laws, multi-vendor workflows, payment settlement rationale, and carrier integrations at a deep technical level.

The success of the marketplace is determined by the strength of operations and not on the visual design. Any scalable marketplace is based on vendor onboarding, commission management, payout cycles, shipping regulations, and compliance. These systems should not be added subsequently, but should be planned together.

For marketplace founders aiming to enter the US market, the most essential things before entering are compliance, automation, and sellers’ experience. CartCoders assists companies in creating a well-built marketplace commission model that meets regulatory requirements and scales for a confident launch that runs without issues.

Vendor onboarding is the process of registering, verifying, approving, and activating sellers on a marketplace with appropriate permissions and security measures in place.

It involves the creation of accounts, the verification of business, the approval processes, access to dashboard, and selling permissions.

Business information, taxation ID, bank data, contact information, category permission are normally needed.

The most common one is the percentage-based commission per order.

The rules are used to automatically calculate commission at the order and settlement level based on the platform.

Settlement periods, fraud windows, and payment processor regulations determine payout plans.

It is the time between the completion of an order and payment to the seller.

Different vendors may have different shipping origins, carriers, rates, and logic of fulfillment.

The marketplace facilitator collects and remits taxes in avenues in most states.

They determine the calculation, collection and reporting of tax among various sellers.

There is a need of identity verification, tax identification and bank account validation.

The most frequently used carriers are UPS, USPS, and FedEx.

Projects delivered in 15+ industries.

95% retention rate, building lasting partnerships.

Serving clients across 25+ countries.

60+ pros | 10+ years of experience.