Custom Engagement Solutions

Unlock tailored solutions with a free, no-obligation strategy session.

Expert Developers & Engineers on Demand

Scale Your Team with Skilled IT Professionals

Expert Guidance for Digital Transformation

Selling adult products online is completely legal in most countries, yet many store owners find their payment gateway suddenly disabled. The reason isn’t content, it’s classification. Banks and processors mark adult stores as “high-risk.”

This tag doesn’t mean you’ve done anything wrong. It just signals that the business handles sensitive products, has high refund ratios, or stricter identity checks. Because of that, regular gateways like Shopify Payments, PayPal, or Stripe may refuse service or hold funds for months.

Many merchants learn this only after their store goes live—when transactions start failing and customers can’t complete checkouts. That’s when panic sets in.

In this guide, we’ll explain why mainstream gateways decline adult stores, what triggers these flags, and most importantly, what alternatives exist that actually work.

Adult stores fall into the high-risk category because of:

Even if your store focuses on wellness or relationship products, banks often treat all adult categories the same way.

| Gateway | Adult Store Policy | What Happens in Practice |

| Shopify Payments | Not allowed for adult items | Store forced to use third-party processors |

| PayPal | Prohibits adult content and toys | Funds may be frozen for 180 days |

| Stripe | Reviews case-by-case | Often rejected after the first transaction |

| Square | Accepts only certain sub-categories | Needs prior disclosure |

| Authorize.net | Accepts via partner high-risk accounts | Requires manual setup |

These restrictions are less about morality and more about risk tolerance and compliance pressure from acquiring banks.

Even if you think you comply, automated reviews can flag your store. Common causes include:

Once flagged, gateways may suspend your account without prior notice.

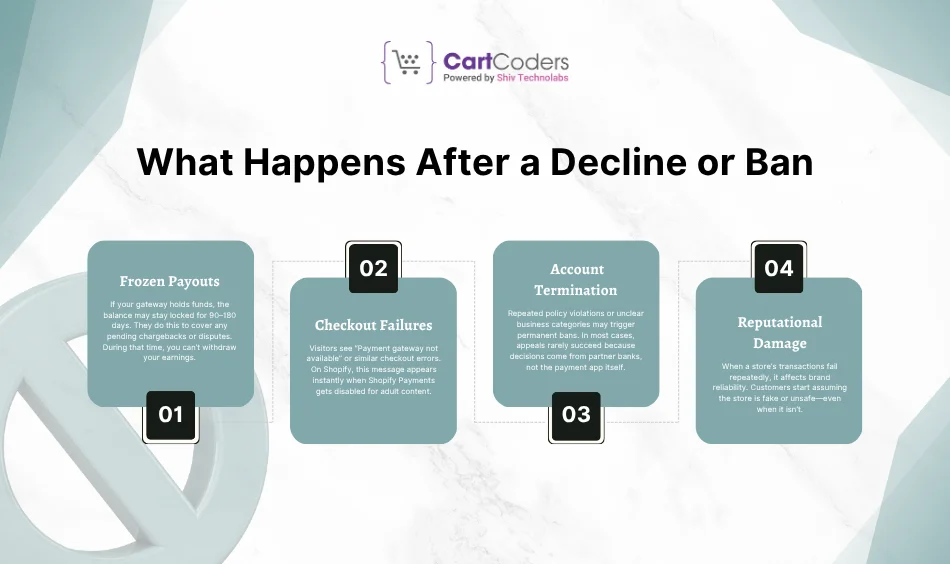

When a payment gateway flags or suspends your store, the impact is immediate. Orders fail, payouts freeze, and customer trust drops. Here’s what typically happens behind the scenes:

If your gateway holds funds, the balance may stay locked for 90–180 days. They do this to cover any pending chargebacks or disputes. During that time, you can’t withdraw your earnings.

Visitors see “Payment gateway not available” or similar checkout errors. On Shopify, this message appears instantly when Shopify Payments gets disabled for adult content.

Repeated policy violations or unclear business categories may trigger permanent bans. In most cases, appeals rarely succeed because decisions come from partner banks, not the payment app itself.

When a store’s transactions fail repeatedly, it affects brand reliability. Customers start assuming the store is fake or unsafe—even when it isn’t.

Tip: Keep one extra merchant account ready. It’s easier to switch gateways than to recover from lost sales.

Instead of fighting with mainstream gateways, move toward payment providers that support adult eCommerce. These processors understand chargeback risks and follow stricter KYC (Know Your Customer) steps during onboarding.

Below is a practical comparison you can refer to:

| Gateway | Transaction Fee | Setup Time | Supported Platforms |

| CCBill | 3.9–6% | 7–10 days | Shopify, WooCommerce, Custom |

| SegPay | 4–6% | 5–8 days | Shopify, BigCommerce |

| Verotel | 3–5% | 10 days | Shopify, Custom API |

| Epoch | 4–5% | 7 days | Shopify, WordPress |

| Paxum | 2–4% | 3 days | Global transfers |

These gateways specialize in high-risk businesses, including adult, wellness, and entertainment categories. They also offer discreet billing descriptors to protect customer privacy.

Smart routing means connecting two or more gateways and switching them automatically if one fails. It keeps your checkout live even if one processor goes under review.

Example:

Use CCBill as the main gateway and Paxum as backup. This prevents any sudden revenue loss during audits or delays.

Gateways approve faster when your store includes:

These small steps prove your business operates responsibly and can help you get verified faster.

Avoid words that trigger compliance filters. Instead of direct product names, use technical or wellness-based terms.

Example:

❌ “Vibrator with 10 speeds”

✅ “Rechargeable body massager with adjustable intensity”

This minor change reduces flag risk on payment and ad platforms.

Add secure payment badges, visible privacy statements, and quick refund options. When customers feel safe, they complete checkouts even with third-party gateways.

Once your adult store reaches consistent volume (usually above $100k/month), creating your own mini payment gateway becomes realistic.

Here’s what it means:

Why it’s worth it:

Example:

A wellness brand can create “WellPay”—its own gateway connected to a verified acquiring bank. With custom fraud filters and discreet descriptors, they keep 100% control over the checkout experience.

It’s an investment, yes, but one that pays back in stability, privacy, and peace of mind.

Getting approved by a payment processor is just the first step. Staying approved is the real game. Gateways love merchants who keep disputes low and customer confidence high.

So how do you win that trust? Let’s keep it practical.

Start with your billing name.

Use a neutral descriptor that looks normal on a bank statement. Something like “CC Wellness Shop” instead of anything too direct. It avoids awkward calls from customers asking, “What’s this charge?”

Refunds and transparency go hand in hand.

People dispute charges when they feel ignored. Keep your return policy clear and visible on product pages and in checkout. If hygiene rules apply, explain them early. Quick refunds always cost less than a chargeback.

Proof beats panic.

When a dispute hits, that single tracking ID often decides who wins.

Security isn’t optional.

Turn on these basics across every processor:

They filter fraud before it reaches your balance.

Customer service can save your account.

Respond to emails or chats within 24 hours. Be polite, quick, and clear. A calm reply turns a frustrated buyer into a repeat one.

✅ Bottom line: When banks see that you manage refunds, verification, and disputes proactively, you stop being a “risk.” You become a reliable partner.

Once your payments run smoothly, the next focus is stability. Adult stores can’t afford downtime—one paused gateway can freeze an entire week of sales.

Here’s how to stay ready for anything.

Run with two engines.

Keep a primary and backup processor. Split volume (80/20 or 70/30) so both stay active. If one freezes during review, the other keeps orders flowing.

Do monthly checkups.

Treat your gateways like you’d treat store security:

Keep compliance visible.

Every processor wants to see that you play by the rules. Make sure your store has:

These pages show responsibility—and they also help with ad approvals.

Build relationships, not just accounts.

Payment reps are human. Let them know when you’re running campaigns or adding new SKUs. Early communication avoids surprise reviews and can even earn fee reductions later.

Document everything.

Keep copies of agreements, chargeback logs, and SOPs. If a review starts, you’ll respond within hours—not days.

Selling adult products online requires more than a beautiful store — it demands a payment setup that stays active, compliant, and secure. That’s where our team at CartCoders steps in.

We specialize in secure payment gateway integrations for Shopify and custom-built stores, helping adult wellness brands accept payments safely across different regions.

Our developers also create custom payment gateway extensions for brands that want full ownership of their processing flow — from KYC to transaction routing.

Whether you’re just starting with third-party gateways like CCBill and SegPay, or planning to build your own private payment system, we help you connect every piece — discreetly and reliably.

🔒 Secure integration. Smarter checkout. Zero downtime.

That’s the CartCoders way of keeping your business payment-ready at every stage of growth.

Adult eCommerce doesn’t fail because of customers; it fails when payments stop flowing. Every successful brand in this space learns one rule early—control your payment path before it controls you.

Start small with reliable high-risk gateways like CCBill or SegPay. Add smart routing and proper age checks.

Then, once sales grow, consider building your own gateway and becoming the one setting the rules—not following them.

Payment stability isn’t luck; it’s strategy. If your checkout runs without interruptions, your reputation, revenue, and repeat buyers grow naturally.

If you’re ready to secure your store’s future, we can guide you through every step—from gateway selection to full-scale integration. Contact CartCoders today!

Because banks see higher refund and dispute rates in this category. It’s about financial exposure, not legality or morality.

No. Shopify Payments restricts adult content and redirects merchants to approved third-party processors like CCBill or SegPay.

Usually 5–10 business days, depending on documents, KYC checks, and regional rules.

Keep billing names neutral, ship with tracking, and reply to customer emails quickly. Most disputes start when buyers can’t identify a charge.

It requires technical setup and a merchant-bank partnership, but it becomes cost-effective once you process $100k+ per month or run multiple stores.

Yes. Providers like CCBill and Epoch handle multiple currencies and countries while staying PCI-compliant.

That’s where smart routing helps—your backup processor keeps transactions running while you resolve the issue.

Some adult-friendly processors offer Bitcoin or stablecoin options, but you should confirm legality in your operating region.

Yes. Your ads must use non-explicit visuals and direct to age-gated pages. Payment setup doesn’t override ad policy.

We set up secure, policy-compliant payment systems for adult stores—integrating approved gateways, routing tools, and privacy safeguards under one checkout experience.

Projects delivered in 15+ industries.

95% retention rate, building lasting partnerships.

Serving clients across 25+ countries.

60+ pros | 10+ years of experience.